By John Martin

(Please contact John on 01481 728432 or email john.martin@bwcigroup.com

if you wish to discuss this article or anything relating to secondary pensions).

The States of Guernsey have recently issued subordinate legislation in relation to Secondary pensions (“called the Secondary Pensions (Guernsey and Alderney) regulations, 2023”) and Statements of Practice which supplements The Secondary Pensions (Guernsey and Alderney) Law, 2022 (“the Primary Law”).

1. What new details are in the subordinate legislation and Statements of Practice?

- Confirmation on when the changes will happen (see Question 2)

- The Notices which Employers need to send to staff and what they need to contain (see Question 3)

- The requirements for Approbated Pension Schemes around; refund of contributions, benefit options if individuals leave service and transfer payments

- Compulsory membership of pension schemes and the use of Your Island Pension (“YIP”) if Employers have an existing pension scheme

2. When will the changes happen?

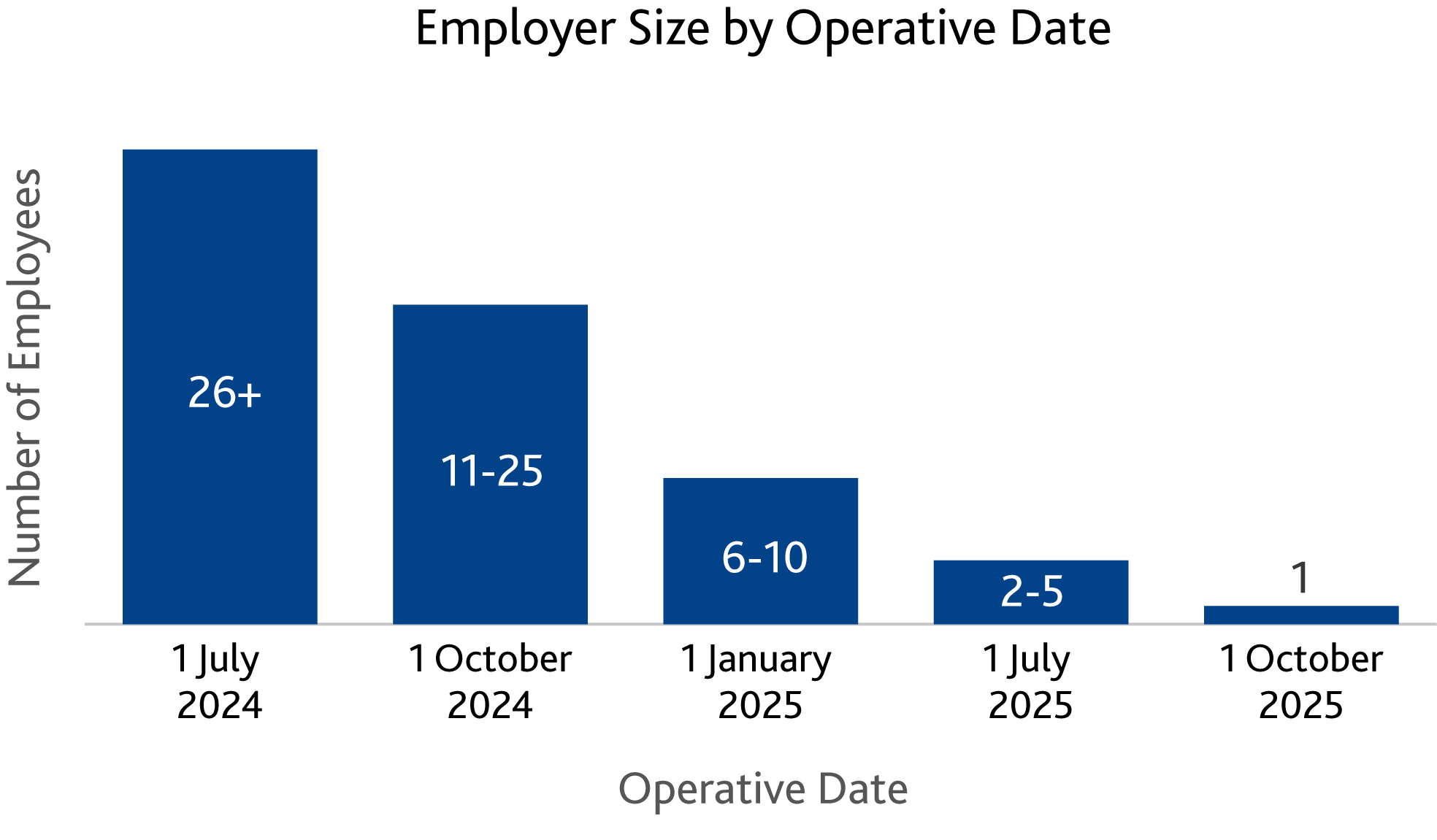

The States have confirmed the phasing in of secondary pensions so that it starts with big employers who have more than

26 employees, and over the following 15 months all employers would be brought into the scheme.

The launch date has been confirmed to be 1st July 2024.

The States have confirmed the number of employees is determined based upon your quarter 2 employer schedule submitted to Revenue Services ie as at 30 June 2024.

3. When must Notices to employees be issued and what must they contain?

Employers will need to either issued a Notice of Immediate Enrolment or Notice of Deferred Enrolment (if the Employer does not auto-enrol from day one of employment) ONLY if the Employer does not have contractual membership as a condition of employment. These Notices will need to be issued at the later of the Operative Date or when the employee commences employment. The content of the Notices will need to contain:

- Confirmation of when they will be auto enrolled

- High level features of the Blue Riband Plan

- High level features of YIP

- The option to opt out

BWCI have drafted templates for our clients to use and these will be made available shortly.

4. How much will it cost?

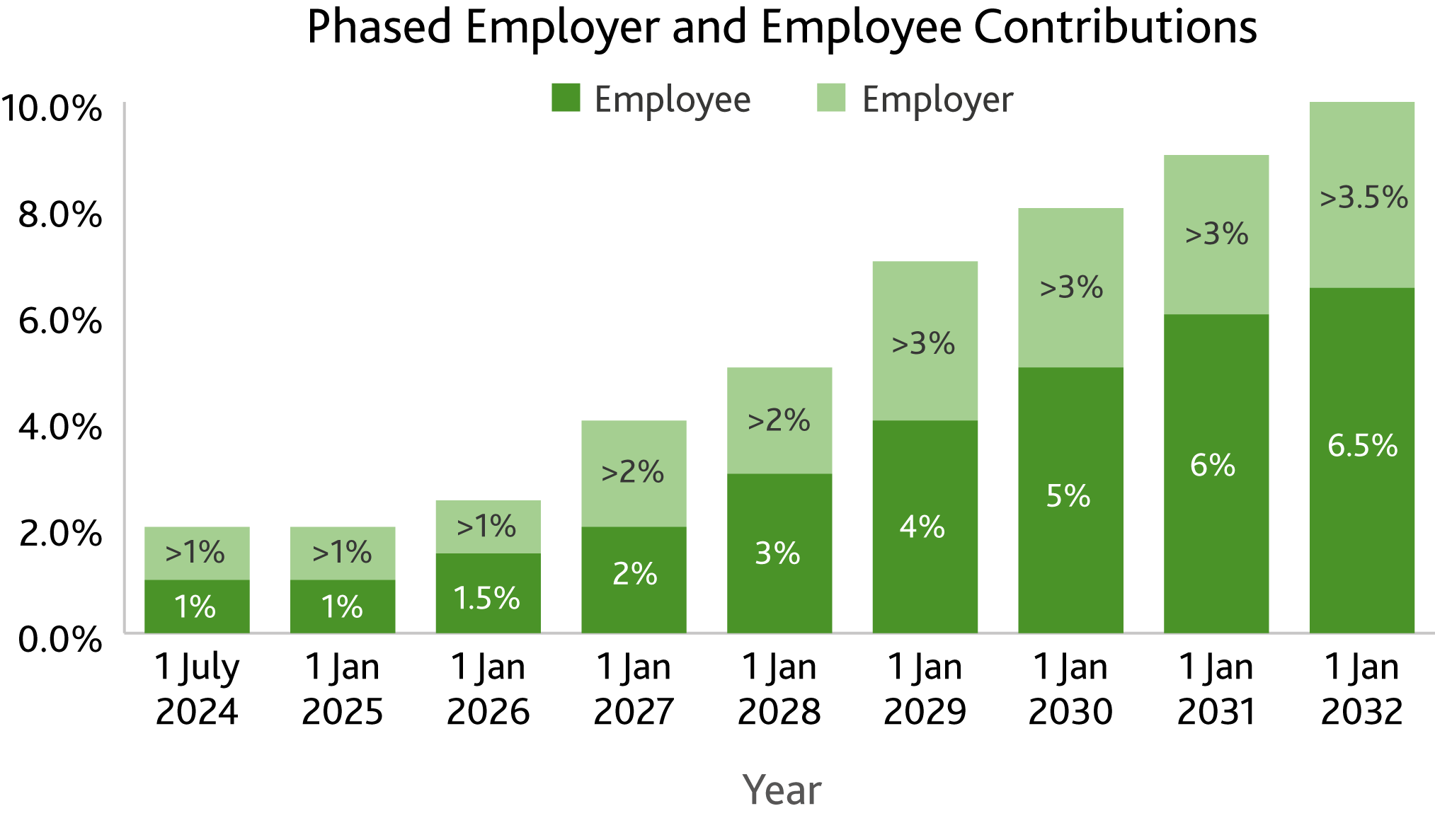

Initially, those included in auto-enrolment will contribute 1% of their gross earnings into their pensions from their pay.

That modest figure would be matched by their employers. Contributions will be slowly stepped up, so, by the time nine years have elapsed, the employee will pay in 6.5% of their gross earnings and the employer will have to pitch in with 3.5%.

You may need to review your contributions rate structure and the remuneration these contributions are based on to ensure that the Employer/Employee contributions are above the statutory minimum amount as detailed in the chart below.

5. Who?

Employers will be required to automatically enrol every employee who earns above the lower amount for social security contributions, is aged between 16 and their States pension age, is not in full-time education, and is currently not in an Approbated Pension Scheme.

Self-employed individuals are not yet part of the secondary pensions, but the intention is to eventually bring them into the fold. Employers who already offer their staff a pension scheme must ensure that it has ‘approbated scheme’ status and ensure compliance with other aspects.

6. What should Employers be doing now?

We recommend that Employers should:

- If you don’t have a group corporate pension scheme set one up now

- Review contracts and staff handbook in relation to pension schemes

- Review contributions rates and the remuneration they are based on (if you already have a pension scheme)

- Produce Notices to be given to your staff (note BWCI have drafted templates and these will be made available shortly)

- When budgeting factor in pensions contributions

- Check payroll systems can accommodate pension contributions

At BWCI Pension Trustees Limited (“BWCI”) we’ve already helped many employers with their pension schemes. We are one of the largest pension providers in Guernsey with about 140 staff, and with a track record of experience and expertise over the past 40 years.

Highly personalised and cost-effective, we make secondary pensions simple and quick. There’s no need to wait until your operative date, you can do it right now.