By Claire Du Feu at BWCI

claire.dufeu@bwcigroup.com

“the hope is that it will engender a similar pensions savings culture on the island”

As 1 July 2024 approaches, the secondary pensions compliance deadline for employers in Guernsey and Alderney with at least 26 employees, what can we expect from the introduction of the new legislation?

What’s been happening?

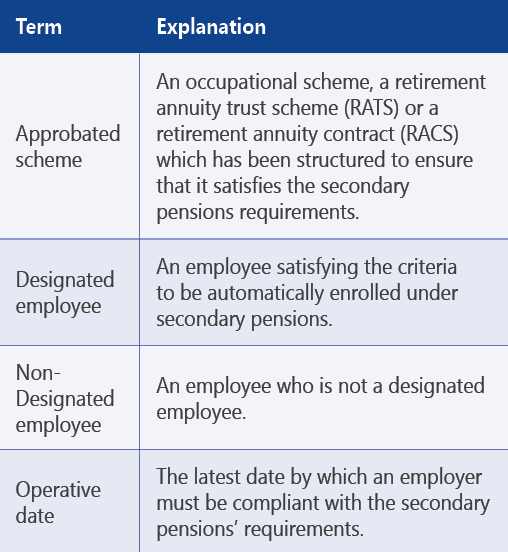

The last few months has seen a flurry of preparatory activity from all stakeholders; employers, the States of Guernsey, the Guernsey Revenue Service, pension providers and industry bodies. The jargon associated with putting the legislation into operational practice has now entered the vernacular… “designated” and “non-designated employees”, “operative dates” and “approbated schemes”.

In addition, the operational processes which employers and pension providers need to be put in place are now much clearer. The Guernsey Revenue Service has published a number of Statements of Practice, which provide guidance on various questions that have cropped up so far as stakeholders work through their implementation plans.

Why are secondary pensions being introduced?

The States of Guernsey’s website says:

“The Secondary Pensions Law was introduced to enable islanders of working age to save more for their retirement so that they won’t have to rely solely on the States Pension and tax-funded welfare benefits later in life.”

The intention all along has been that the regime must be simple to operate and that employers should not have to worry about pensions becoming an administrative burden to their businesses.

The UK’s experience

In November 2022, 10 years after the introduction of auto-enrolment in the UK, the UK Department for Work and Pensions published a press release stating:

“Ten years of Automatic Enrolment achieves over £114bn pension savings.

In 2021, employees across the UK saved £114.6 billion into their pensions. This is a real terms increase of £32.9 billion compared to 2012, when Automatic Enrolment was introduced.

The figures reveal how the policy has transformed pensions saving over the last ten years for people from Sterling to Southend, by normalising workplace pension saving, establishing a culture of retirement saving for a new generation, and helping foster a greater sense of security in later life.”

Guernsey’s politicians must be hopeful that the introduction of an auto-enrolment regime will bear similar fruits to those in the UK’s well-established pension saving regime.

Creating a savings culture

As all Guernsey employers will be required to comply with the legislation at some point over the next 15 months, the hope is that it will engender a similar pensions savings culture on the island. Employers will be legally obliged to enrol their employees into a pension and many are making membership of the pension scheme a condition of employment to minimise the administrative burden of dealing with opt-outs and the requirement to re-enrol those who have opted out every three years.

Helen Dean CBE, who has been involved with the UK’s auto-enrolment regime since it was implemented, and who now chairs the Governance Committee of Guernsey’s “Your Island Pension” (YIP) scheme, commented at a recent Guernsey Chamber of Commerce meeting:

“As we get more people into the habit of saving, there is a cultural shift in attitudes towards pension provision. As account balances grow, they get a sense of pride and curiosity in what they’re saving for.”

The States estimated that around 60% of the working age population did not have any personal pension provision at all when the secondary pensions policy was first proposed. Currently, those without any retirement savings will be relying on income from other sources including the States Pension. However, as it stands, three out of four people in Guernsey do not qualify for the maximum States Pension as they do not have a full social security contributions record.

It will be interesting to see how the percentage of the working age population with private pension provision changes over time. This will be a key indicator to help assess both the cultural change and financial impact of the new regime for the island’s ageing population.

Jargon Buster