By John Martin at BWCI

john.martin@bwcigroup.com

“the employers’ minimum rate only increases every two or three years.”

The initial stage of the implementation of Guernsey’s Secondary Pensions framework is now complete. This required all employers to put in place pension arrangements, satisfying the criteria, for all of their employees who fall within the scope of the legislation.

The 15 month phasing in period commenced on 1 July 2024, for employers with at least 26 employees, and came to an end on 1 October 2025; the deadline for compliance for employers with just one employee.

During this first phase the minimum joint employer/employee contribution rate was 2% of gross earnings. Gross earnings are the same earnings on which social security contributions are payable and include basic salary, bonuses, overtime, commissions, and other relevant earnings, subject to the upper earnings limit for each pay period.

Changes for 2026

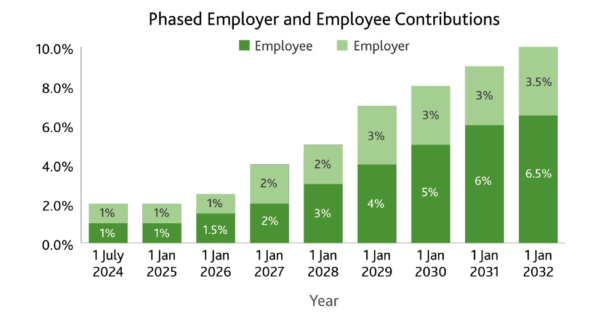

We are now moving into the second phase of the transitional arrangements for secondary pensions. This will see the joint minimum contribution rate increase gradually from 2% to 10% by 2032. The first increase comes into effect on 1 January 2026, with the minimum joint employer/employee contribution rate increasing by 0.5% to 2.5%.

The nominal split of these minimum contributions is 1% from the employer and 1.5% from the employee. However, an employer can choose to pay more than 1%, with any additional employer contributions automatically reducing the employee’s minimum contribution.

Things to watch out for going forward

Increases in employers’ contributions

Employers who have only been paying the minimum contribution rate to date will need to take care to ensure that they have updated their processes and procedures to ensure that the joint minimum contribution rate will continue to be met, by increasing the employees’ contribution rate to 1.5% for 2026. Unlike the employees’ minimum rate, which will increase every year between 2026 and 2032, the employers’ minimum rate only increases every two or three years, so there is a risk that it could be overlooked in future, particularly when the first increase in the minimum employer rate comes into effect from 1 January 2027.

Employers’ own transitional arrangements

Some employers have opted to pay more than the minimum initial contribution rate, but less than the long-term minimum rate of 10%. In some cases this has been to reduce the initial contribution burden on their employees to encourage pension savings amongst their staff. However, at some point over the next few years, the rate the employer has opted to pay will fall below the minimum joint rate.

For example, if an employer had opted to pay 5% pension contributions from the outset, with no compulsory member contributions, this would satisfy the joint contribution rate up until the end of 2028. However, from 1 January 2029 either the employee would need to start contributing, or the employer would need increase their contribution rate by 2%.

Secondary Pensions – minimum contribution rates