By Michelle Galpin at BWCI

michelle.galpin@bwcigroup.com

“embed climate and nature risks into existing risk management frameworks.”

As climate change and nature loss increasingly shape the global financial landscape, the Isle of Man Financial Service Authority (IOM FSA) has issued a comprehensive guidance document aimed at regulated firms, encouraging them to review their risk management strategies to remain resilient and competitive.

What are the risks?

There are three main types of climate and nature risks:

- physical risks, such as extreme weather and ecosystem degradation;

- transition risks, arising from shifts in government policy, technology changes, and consumer preferences; and

- litigation risks, linked to failures in disclosure or poor conduct, such as “greenwashing”.

If a business is not able to say that these risks are well-managed, they could potentially impact creditworthiness, asset valuations, operational continuity or reputational standing.

While each type of risk is challenging to manage in isolation, the greater issue is that they are not independent – they interact and amplify each other. Consequently a holistic approach to risk management is needed in this evolving area.

Double Materiality: A Two-Way Risk Perspective

The IOM FSA’s guidance highlights the concept of double materiality; it is not just about how climate change could affect a business; it is also about how a business impacts its environment. Therefore, firms should be assessing both the impact of climate change on their operations (“outside-in”) and the effect of their activities on the environment (“inside-out”).

Strategic Oversight

The guidance emphasises that effective governance is central to managing both climate and nature loss risks. Regulated boards should ensure that they either have or have access to the expertise to understand long-term environmental risks and integrate this knowledge into their strategic decision-making. This includes setting clear responsibilities for a business’s senior management, reviewing risk appetites and monitoring performance against sustainability metrics. In turn, the management team should ensure adequate resources and expertise are allocated to the management of climate change and nature loss risk.

Risk Management Frameworks

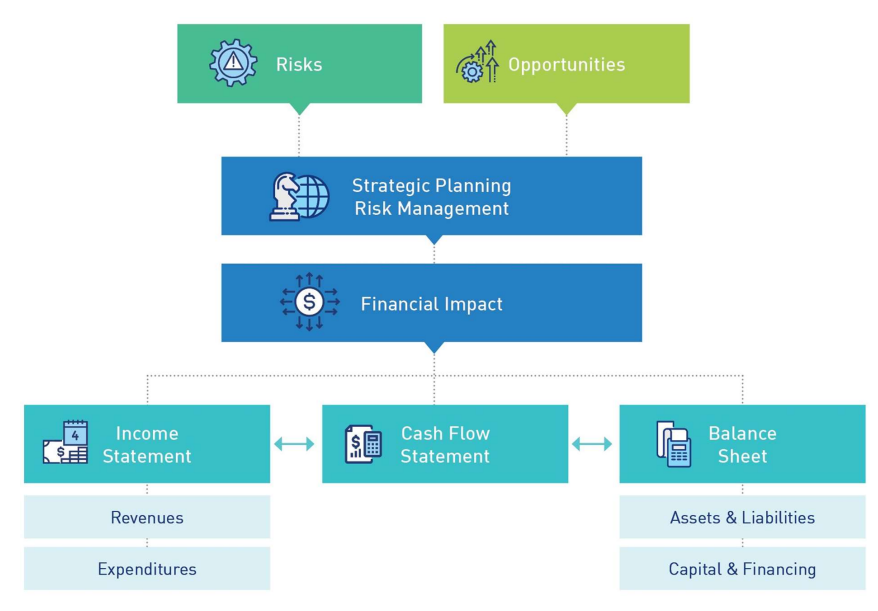

The IOM FSA emphasises that rather than creating standalone systems, firms are encouraged to embed climate and nature risks into existing risk management frameworks. This involves updating policies and procedures, identifying material exposures, and conducting regular materiality assessments. Sector-specific risk criteria – such as vulnerability to extreme weather or regulatory shifts – can guide firms in tailoring their approach. For banks and insurers, capital adequacy assessments via ICAAP¹ and ORSA² processes are particularly relevant.

Source: Financial Stability Task Force on Climate-related Financial Disclosures

Preparing for Uncertainty

Given the unpredictable nature of climate impacts, scenario analysis is a vital tool. Firms are encouraged to simulate both short- and long-term climate scenarios to test resilience and inform strategic planning. While quantitative models are perceived to be optimal, qualitative narratives can also be useful initially, especially for nature-related risks where data is still emerging. Scenario analysis should consider impacts on liquidity, capital adequacy and the ability of a firm to meet its obligations.

Opportunities in Sustainable Finance

Beyond risk mitigation, climate adaptation presents significant opportunities. The Isle of Man’s Sustainable Finance Roadmap highlights areas for innovation, including green bonds, sustainable insurance products, and energy-efficient mortgages. Captive insurers and insurance special purpose vehicles could have role to play in providing cover for natural catastrophes. Embracing these opportunities can enhance reputation, attract talent, and differentiate firms in a competitive market.

Managing financial risk in the face of climate change and nature loss requires a proactive, integrated approach. Embedding environmental considerations into governance, risk management and strategic planning should help firms to safeguard their operations, as well as helping them to identify emerging opportunities in sustainable finance. The full text of the IOM FSA’s guidance can be found on the IOM FSA’s website; www.iomfsa.im.

¹Internal; Capital Adequacy Assessment Process

²Own Risk and Solvency Assessment