Pensions used to be complicated, but changing technology is making planning for retirement increasingly simple. There are apps to manage your banking, shopping, fitness goals, and romantic aspirations – so it makes sense that you should also be able to manage your pension through an app too.

We launched the BWCI app last year and we’ve had a great response from users. It takes seconds to download onto your phone, registering is also quick, and the interface is very easy to use.

BWCI has pension plans to suit everyone, whether you are an employer or an individual. All the details of each of our pension plans are set out within the app, in language that everyone can understand.

Through the app, or through the portal on our website, members can easily see the value of their pensions, keep an eye on how they are performing, and watch them grow. On the dashboard you can check your contribution history ie your contributions and your employer’s contributions. This can help you complete your tax return each year.

One caveat though – it’s worth remembering that you don’t need to be checking your pension savings every day, so try to resist the temptation to fiddle. A pension is a long-term investment shaped by decades of stock market growth and fluctuations.

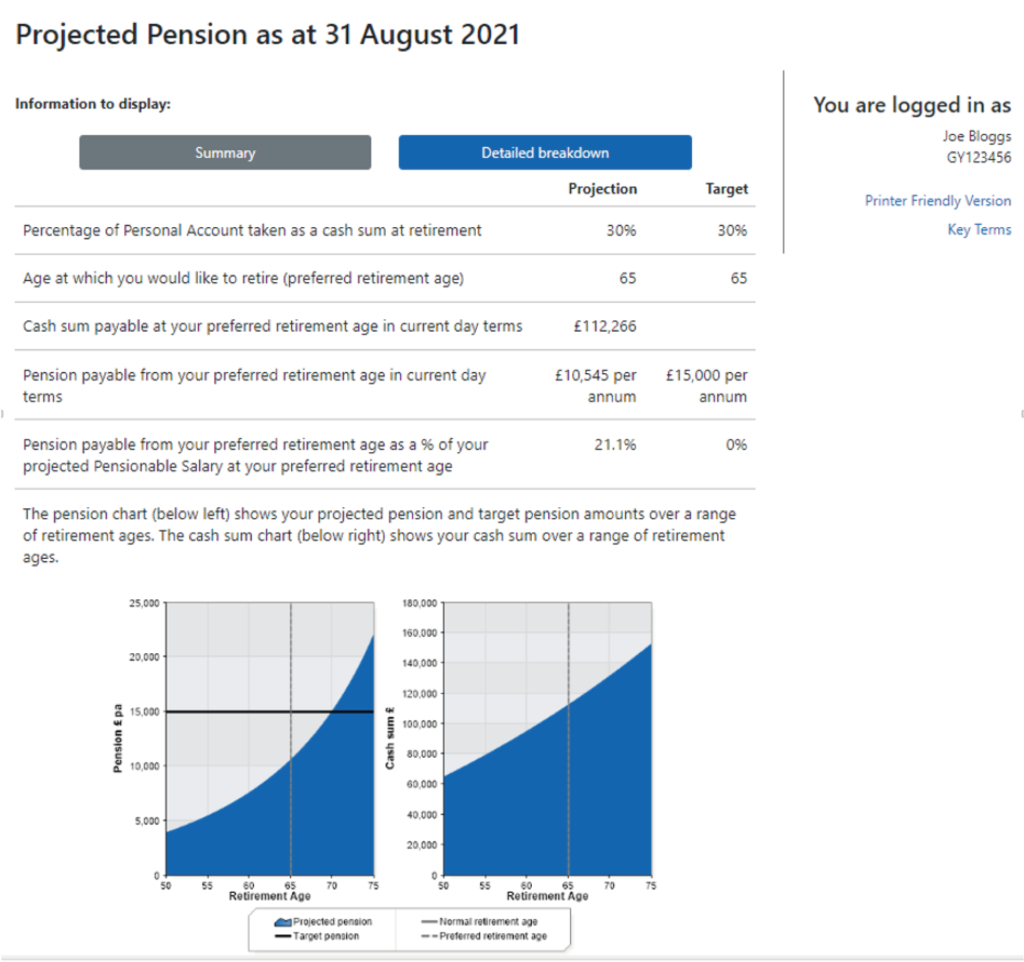

The app is not the only way in which BWCI has grown its digital offering in recent years. We also have a pension projector to give you a forecast of the expected pension income you’ll get when you retire.

If you have a target retirement income eg £15,000 pa, the projector will set out a path to achieve it. You can alter your retirement age and see how increased contributions will affect your nest egg.

There is a new era in the pensions landscape where managing our own pensions and investments has become more important. Money management has become a hot topic and the under-45s in particular want a slick digital offering and hassle-free service. Anything that gets young eyeballs on pension matters and boosts financial literacy is usually a good thing.

The debate around secondary pensions in Guernsey has also inspired more people to think about starting or building their nest egg. Pensions shouldn’t be a source of stress, so we’re keen to do anything that makes it easier to engage with us.

The changes don’t mean that we would ever neglect our older users who can sometimes feel excluded by the digital revolution. Our friendly team who are all Guernsey based are always available at the end of the phone.

To download the free app just go to your favourite app store and search for BWCI.

If you want to find out more about our different pension products in Guernsey, you can speak to our experienced and trusted team on 728432 or email pensions@bwcigroup.com.

Trustee and Administration services are provided through BWCI Pension Trustees Limited, which is regulated and licensed by the Guernsey Financial Services Commission under The Regulation of Fiduciaries, Administration Businesses and Company Directors, etc. (Bailiwick of Guernsey) Law, 2020.