By Carl Stanford at BWCI

“the UK is ranked in the top three

national issuers of green bonds“

What are Green Gilts?

“Green gilts”, a new classification of UK government bonds (“gilts”) were launched towards the end of 2021. This latest form of government debt has the same structure as traditional (“Brown”) gilts, however the money raised is to be used to support a range of sustainable initiatives. Green gilts form part of the UK’s ambition to be a world leader in green finance by helping to fund sustainable projects, driving progress towards net zero and creating green jobs as part of the planned green industrial revolution.

What do they finance?

The UK Government Green Financing Framework was published in June 2021. This sets out the UK’s commitment to being a leader in the global efforts to combat climate change, as well as the types of projects eligible for financing through the green gilts programme and the ongoing reporting to investors. The framework is aligned with the ICMA (The International Capital Market Association) Green Bond Principles and the UK’s developing classification of environmentally sustainable economic activities.

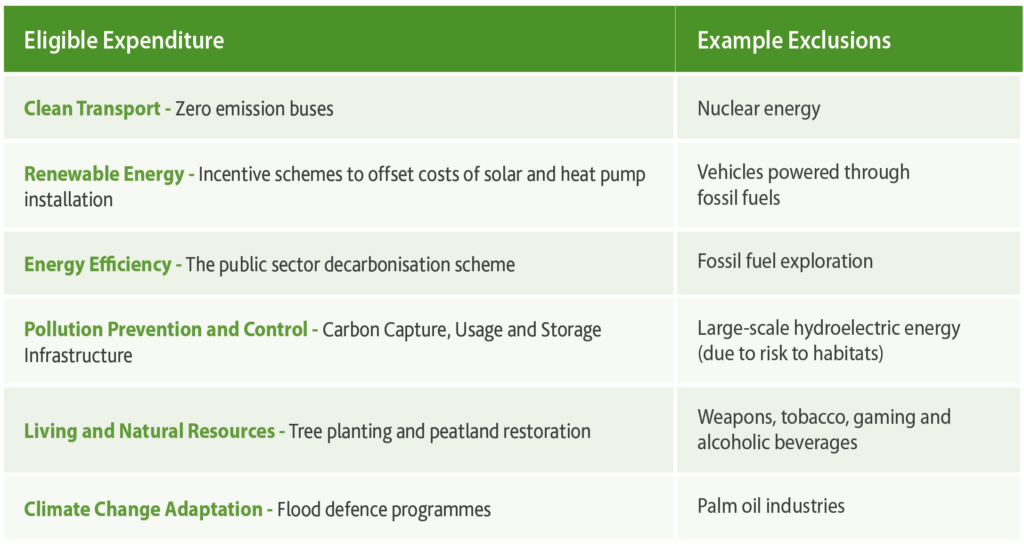

The table below shows some examples both of eligible green expenditure and the areas that would be excluded.

Issuances to date

The UK first issued green gilts in September 2021. The 12 year bond raised £10bn, the largest inaugural issuance of sovereign green debt. It was over subscribed, attracting over £100bn of potential demand. A longer dated 32 year bond was issued a month later, raising £6bn, and was 12 times oversubscribed. With £16bn in green gilts, the UK is ranked in the top three national issuers of green bonds in the world.

The UK plans to issue further green gilts at different maturities to create a full “Green Curve”. It is hoped that this, combined with the established demand, will make it easier for companies to price and issue their own green debt, further developing the green bond market.

The high demand for green gilts has resulted in them being sold at a premium (“Greenium”) to brown gilts, despite them being directly comparable in terms of risk profile.

Green Gilts Investment Characteristics

Default risk – green gilts and brown gilts have the same default risk as they are both backed by the UK Government.

Sustainability – With many pension schemes invested in gilts for hedging reasons, continued issuance of green gilts offers the potential for them to invest in a more sustainable way that has a measured positive effect to society. The ESG credentials of brown gilts could potentially be adversely affected with green projects being financed by green gilts.

Pricing – The smaller issuance of green gilts would be expected to affect liquidity. However, in practice, the demand for green gilts means that it is expected that they will trade at a premium to brown gilts. The market value of green gilts, relative to brown gilts, would be expected to fluctuate, reflecting differences over time in their supply and demand.

Hedging – Green gilts could be used as part of a solution to hedge interest rate risk. However, more issuances with different maturities would be needed before full solutions can be developed. Green gilts currently represent less than 1% of all gilts issued as at end of February 2022, with no green index linked gilts having yet been issued.

Gilt Indices – FTSE have created a green gilts index and green gilts have been included in gilt indices generally. Therefore schemes using passive funds tracking a gilt index are already likely to have some green gilt investment. The UK first issued green gilts in September 2021. The 12 year bond raised £10bn, the largest inaugural issuance of sovereign green debt. It was over subscribed, attracting over £100bn of potential demand. A longer dated 32 year bond was issued a month later, raising £6bn, and was 12 times oversubscribed. With £16bn in green gilts, the UK is ranked in the top three national issuers of green bonds in the world.

Looking forward

The UK Government has set out its roadmap to sustainable investing involving increased disclosures across the economy to inform investors. In addition, it has set out expectations that investors will act on this information with a final phase of measures put in place to ensure compliance with Net Zero targets where required. This is expected to further increase the demand for sustainable investments. Green bonds are expected to be an important element of this transition for investors, in particular maturing defined benefit pension schemes.