By Amber Buckingham at BWCI

amber.buckingham@bwcigroup.com

“there may be changes in circumstances”

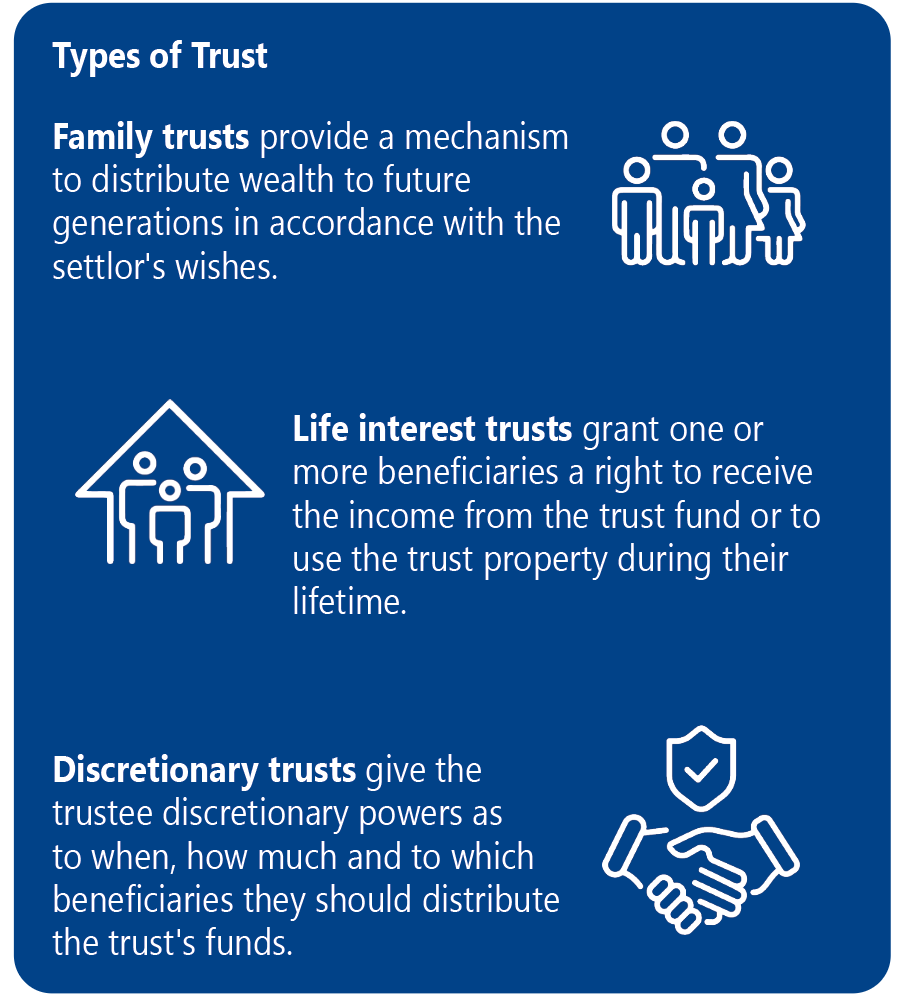

The trust industry is a well-established part of the finance sector in the Channel Islands. Administered by trustees, a trust provides legal separation and protection of its assets from the settlor’s¹ other assets, whilst still enabling the settlor to specify how the trust’s assets are to be used.

Financial uncertainty

Whether a trust will be able to achieve the desired purpose in practice will depend on a variety of factors, including future investment returns, the ongoing operating costs of the trust, the number of beneficiaries and how any discretions are exercised.

For example, the value of the future income payments to the trust’s beneficiaries cannot be known with absolute certainty in advance. This uncertainty relates to:

- Period of payment – it is impossible to know, at the point of valuation, how long individual beneficiaries will live

- Amount of payments – often payouts are discretionary or increase in line with future changes in an inflation index

- Number of beneficiaries – family trusts often provide for income to future generations, where some of the potential beneficiaries have not yet been born. The number of beneficiaries therefore varies, depending on the timing of future births and deaths.

Considering redistribution

After a trust has been set up, there may be changes in circumstances which require its structure to be revisited. This may be at the point where a trust is no longer deemed to be financially viable, when the expenses of running the trust outweigh the potential benefit to the beneficiaries.

In these circumstances, in order for the trustees to decide how a trust’s assets will be rearranged or distributed, it is often helpful to seek a valuation of the interests of the relevant beneficiaries; a fair allocation of a family trust’s assets should take into account the life expectancies of the beneficiaries and any specific requirements of the trust.

Often a bespoke model needs to be developed to reflect the provisions of an individual trust to project forward the future trust payments. This model can then be used to illustrate the sensitivity to each beneficiary’s share of the trust’s assets to changes in the modelling assumptions.

How can BWCI help?

Placing a value on future income streams is a key part of the actuarial calculations required to quantify the financial health of a pension scheme. However, similar techniques can be used to value an income stream from a trust.

BWCI has considerable experience in providing bespoke advice as an expert actuarial adviser in relation to life interests and discretionary trusts, including certification of the allocation of the share of assets between beneficiaries in a variety of scenarios.

What information is required?

The information required will depend on the nature of the specific trust but could include:

- in respect of a life interest in a trust property, the market value and rental income of the property at the point the life interest is to be valued;

- in respect of any other income stream, details of how the income stream is determined and any information on the expected rate of return on the trust’s assets;

- sufficient information to be able to estimate the life expectancies and number of current and potential beneficiaries (e.g. a family tree, any factors affecting life expectancy);

- the operating costs of the trust.

¹The person who created the trust