By Mark Colton at BWCI

“This measure can be used for

asset classes other than equities”

My previous article, in the last edition of Bandwagon, set out the case for taking investment action in the face of climate change. However it was silent on implementation. So this article examines:

- greenhouse gas metrics

- ESG (Ethical, Social, Governance) issues

- greenwashing

Greenhouse Gas Metrics

It is one thing to make reassuring promises, but quite another to deliver. The key climate change goal is to have the world net zero by 2050, meaning that human-related activity produces no net GHG (greenhouse gas) emissions by that time. In addition, this is to be achieved in an orderly manner, a steady year-on-year transition

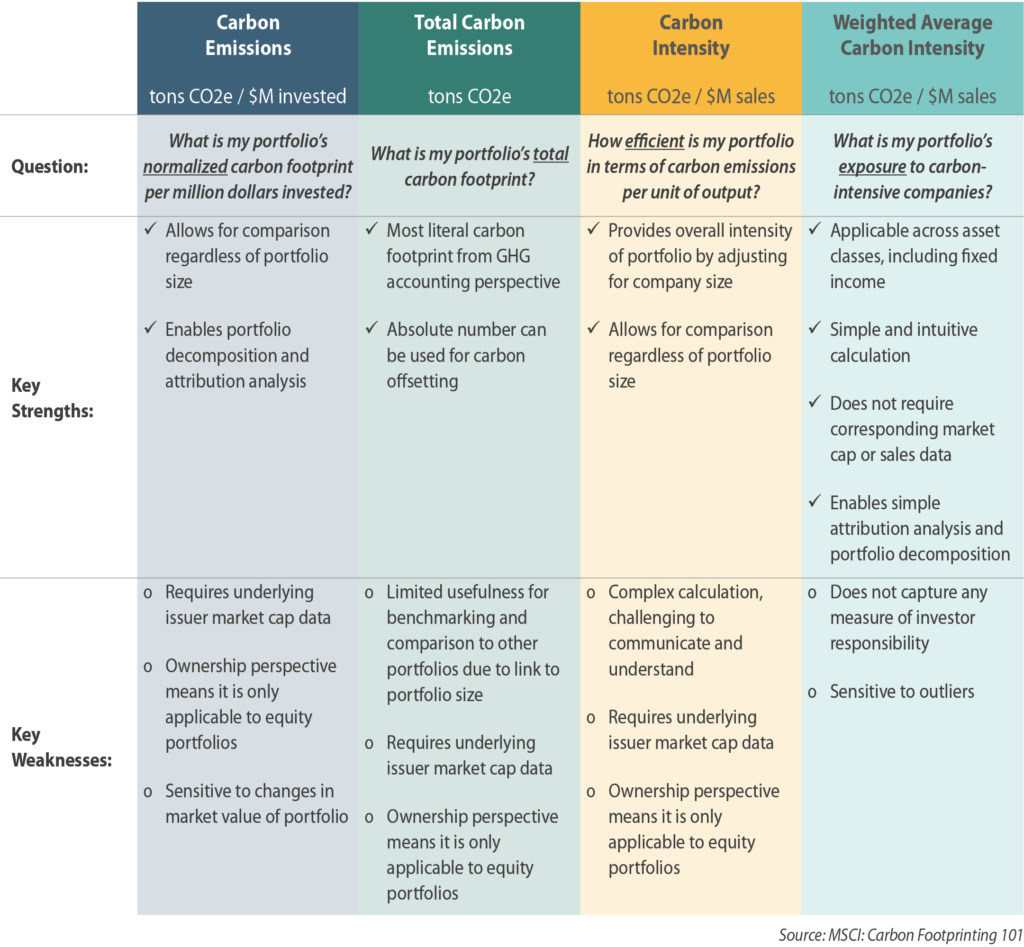

Asset owners, such as pension scheme trustees, need to be able to measure the net GHG emissions of the companies within their portfolios. Unfortunately, there is more than one way to calculate this number (see table), but the favourite of the influential Taskforce on Climate-related Financial Disclosures is Weighted Average Carbon Intensity. Importantly this measure can be used for asset classes other than equities. Since most pension schemes include bonds, this is a critical factor.

This measure is typically expressed as a number of tonnes of GHG per million dollars of company revenue. This number can be measured at regular intervals, and should fall smoothly to zero by 2050. You may see it written as, for example:

120 tCO2e / $m

“CO2e” means carbon dioxide equivalent, which is a handy way for the experts to express a measure of GHG.

ESG

Environmental, Social and Governance issues are ethical concerns that have had a place in investment management for many years. Historically, their role has been associated particularly with the charitable or faith sectors. However in recent years they have come into the mainstream, as sustainability concerns have grown amongst investors generally.

ESG is perceived as representing sustainable investment in the broadest sense. Although climate change has assumed

stand-alone status because of its magnitude, it would be captured in the “E” part, along with biodiversity, pollution, plastic use and land degradation, for example.

Investment and fund managers may have investment policies that include ESG factors, as well as those specifically targeting climate change. However, ESG is to some extent subjective: does Elon Musk’s role in Tesla warrant its exclusion, or is an electric car and battery maker a key green investment? More generally:

- there are many different interpretations and applications of ESG

- there can be inconsistencies between ESG and climate change

- it may be difficult to find a climate-aware fund without ESG

Whilst this means asset owners may be faced with compromises and dilemmas, doing something is likely to be a better option than doing nothing.

Greenwashing

Marketing is every bit as competitive in the investment world as it is for foodstuffs. The branding equivalents of “low in fat” and “natural ingredients” are “ESG” and “green”. However, every investment product wants to carry this message, whether or not it is true. Therein lies the problem of greenwashing.

It is not a minority sport, either: Bloomberg reported that 55% of funds marketed as low carbon, fossil-fuel free and green energy exaggerated their environmental claims. Over 50% of climate-themed funds fell short of Paris Agreement goals. The regulators are investigating.

![]()

Summary

Doing the right thing is made easier by having climate intensity yardsticks to measure progress to net zero. Some due diligence is required, however, to balance any ESG requirements with climate change objectives and to avoid greenwashing pitfalls. However, the climate investment specialists at BWCI are familiar with the issues, and happy to guide trustees and employers through the maze.