What’s changing?

The States of Guernsey have recently announced that self-employed company owners currently paying self-employed social security contributions will automatically become employed for social security purposes from 1 January 2025 unless they opt to remain self-employed.

This has a wide ranging impact on your pension arrangements which are highlighted below.

If I change from self-employed to employed are there any pension implications?

Yes, the change to your social security status would also affect your position for the newly introduced secondary pensions law. The change would mean you would move from being a “Non-Designated” to a “Designated Employee” under the secondary pensions law. By becoming a Designated Employee, you would need to auto-enrol yourself into an Approbated Pension Scheme (this is a particular sort of pension scheme which complies with the requirement of the secondary pension law), from a certain date and pay minimum contributions unless you decide to opt-out.

When will I need to auto-enrol myself into an Approbated Pension Scheme?

When the secondary pension law applies depends on the total number of employees each entity which employs staff has as at 30 June 2024. This is commonly referred to as your Operative Date. It does not matter if there have been any increases or decreases to the number of employees which you have after this date but the number is determined as at 30 June 2024 and in particular the number of employees you submitted in your quarter 2 2024 return to Revenue Services.

It’s important to note the definition of employees is ALL employees including seasonal, temporary and zero hours contracts.

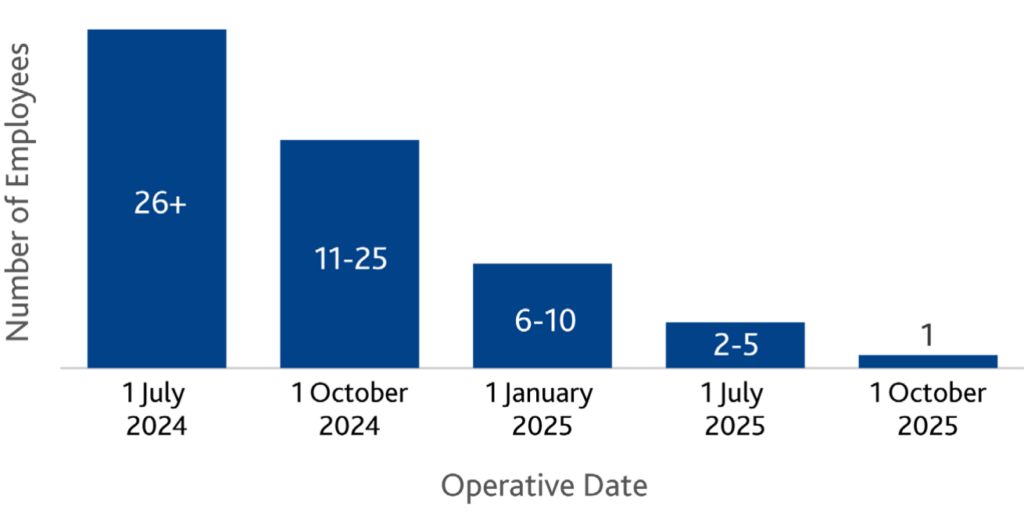

The chart below gives you the details of Employer’s Operative Dates and they are as follows:

Employer Size by Operative Date

We suggest that look at your quarter 2 2024 return to Revenue Services for your number of employees and then look at the chart above to determine your Operative Date and make a note of this. Please note if you are the sole employee of the company your Operative Date will be 1 October 2025.

How much is it going to cost me?

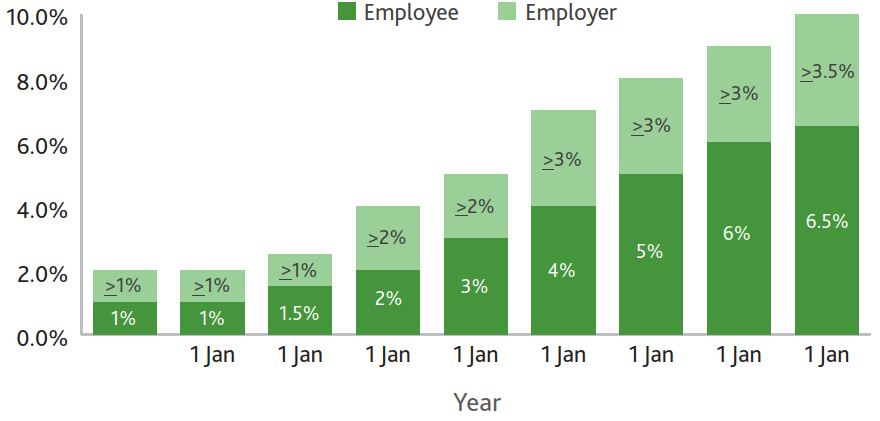

Details are set out on the chart below.

Phased Employer and Employee Contributions

Note: Employees do not have to contribute if the total contributions meet the minimum levels

I already have a personal pension scheme which I have been paying into for a number of years. Can I use this?

Only Approbated Pension Schemes can be used to meet these requirements. It is unlikely that your existing personal pension scheme is an Approbated Pension Scheme since it does not have certain features required by the States of Guernsey. It might be an ideal time to review your retirement savings.

How can BWCI assist?

BWCI can provide guidance on how the secondary pensions law applies to you. Also, we can set-up and operate an individual pension scheme (which is an Approbated Pension Scheme) to help you save for retirement and you can transfer in benefits from previous pension schemes. At BWCI Pension Trustees Limited (“BWCI”) we’ve already helped many employers and individuals with their pension schemes. We are one of the largest pension providers in Guernsey with about 140 staff, and with a track record of experience and expertise over the past 45 years.