By Michelle Galpin at BWCI

michelle.galpin@bwcigroup.com

“the risk of incurring an

uncapped liability will be

a cause for concern”

The Government of Jersey has consulted on its proposals to extend the remit of the Office of Financial Services Ombudsman (“OFSO”) to pensions. It is also proposing to introduce a UK Pensions Ombudsman style framework for pension-related complaints, with uncapped compensation and restitution awards. A short consultation was launched towards the end of January and the feedback is awaited.

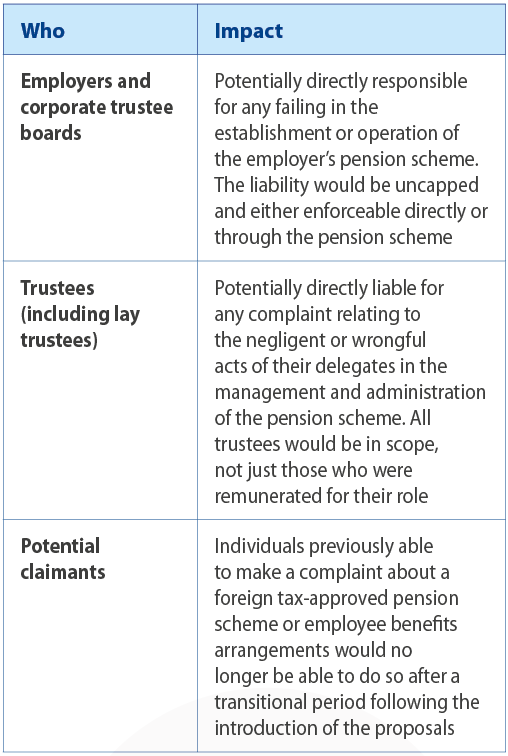

If implemented as proposed, the new requirements could have a direct impact on:

- the sponsoring employers of Jersey tax-approved pension schemes

- lay trustees of Jersey pension schemes

- potential complainants

Background

The Government of Jersey has previously stated its intention to introduce a phased, proportionate approach to the introduction of pension regulation in Jersey. The first phase of the regulatory framework, which came into effect in 2022, introduced regulation of advice in relation to pension products in the retail market.

This second regulatory phase seeks to improve and standardise the duty of care required of those responsible for the management or administration of pension of local consumers’ pension arrangements. The change would see occupational pension schemes, including lay trustees of such schemes, brought within the remit of the OFSO. The Public Sector Employee Pension Schemes would also be within the regulatory scope.

What might it mean for you?

Levy

The OFSO is a self-funded body and it is likely that a levy would be imposed on those falling within the scope of the OFSO. However, at this stage, there is no indication of the amount of any levy or how it would be determined.

What should trustees and employers be doing?

While designed to ensure occupational pension schemes in Jersey are well-run, the risk of incurring an uncapped liability will be a cause for concern for many, particularly lay trustees.

Now is a good time to review a scheme’s processes and procedures to check that members’ instructions and queries are dealt with promptly, together with a review of the strength of the financial and cyber security controls in place. These checks should cover functions carried out in-house, as well as outsourced to third parties.

Trustees may also wish to check on the existing protections provided for them under their agreements with any third party providers in the event of a member’s complaint being upheld. They should also review whether there is adequate insurance cover is in place in the event of a claim.

If you would like more information about a review for your scheme, pleased contact your usual BWCI consultant.