By Matt Stanbury at BWCI

matt.stanbury@bwcigroup.com

“challenging

questions

from auditors!”

With so many companies having a 31 December financial year end, the pension scheme accounting season has been in full swing for several weeks now. The changes in economic conditions over the last year mean that defined benefit pension schemes’ liabilities are looking materially different from those of a year ago. Unsurprisingly, this has resulted in some challenging questions from auditors!

The issues have been caused by a combination of the significant increases in corporate bond yields and inflation over 2022.

So what’s happened?

Corporate bond yields

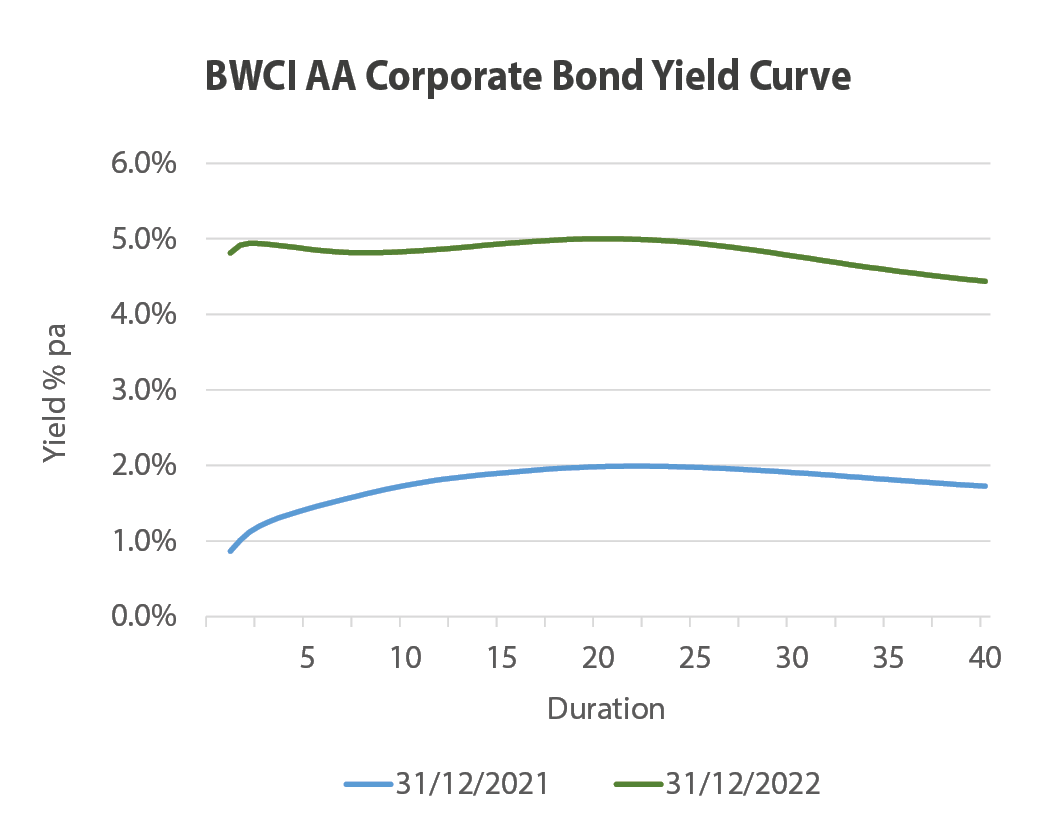

The chart shows how AA corporate bond yields at different durations have changed over 2022.

The increase in yields between 2021 and 2022 has been around 3%. Consequently discount rates are considerably higher than they were this time last year. These higher discount rates significantly reduce the value placed on a pension scheme’s liabilities – a 50% reduction would not be unusual. Despite some falls in asset values over the last year, many schemes are now showing a surplus, possibly for the first time.

While many companies will welcome this potential boost to their balance sheet, an additional check is required to consider the extent to which any surplus can be recognised.

Depending on the accounting standard applied, in some circumstances for the surplus to be recognised in full, the employer needs to have an unrestricted right to a refund of the surplus. This may require consideration of the scheme’s wind up rule. If it is unclear how the rules should be interpreted, the situation should be discussed with the company’s auditors and a legal opinion might also be required.

Inflation

The current high levels of price inflation could potentially lead to a significant increase in pension benefits. However, the impact on a particular scheme will depend on what increases apply under the scheme’s rules.

Given the current high inflation environment, some of the questions from auditors this year include:

- whether any special “discretionary” pension increases are likely to be awarded and whether allowance has been made for them?

- where applicable, whether any allowance has been made for the next pension increase being above the current assumption?

- if any salary increase assumption remains appropriate and whether it has been discussed with the employer?

The explanations in the financial disclosures are also likely to need to be expanded to cover the approach adopted and, if appropriate, how this is different from the previous year.

Deferred pension revaluation

Guaranteed statutory increases to benefits in deferment¹ in the UK and the Isle of Man are linked to price inflation, with an overall cap of 5%pa or 2.5%pa over the whole period of deferment. Deferred pension increases provided by a Channel Islands scheme will depend on its rules – there are no statutory minimum increases.

In view of the sharp increase in price inflation during 2022, the next deferred pension increase could be substantial. This is because as inflation has been below the 5% cap in prior years, members will have built up “headroom” under the cap. This means that deferred pensions could increase with uncapped inflation in some future years, until all of the headroom has been used up.

The 2022 year end disclosures may well be the first time that this has happened and could potentially result in some large pension experience losses; the text in the disclosures may need to be expanded to cover this.

In a nutshell

An employer with a defined benefit pension scheme needs to report the surplus or deficit in its defined benefit pension scheme on its balance sheet. This figure is generally the difference between the market value of the scheme’s assets and the value placed on its liabilities discounted by reference to the yield on AA corporate bonds.

¹ The period between when a member leaves service and commences their pension