Guernsey Secondary Pensions Update PDF Article

By Michelle Galpin at BWCI

A draft of the Secondary Pensions Law¹ was published on 3 October. This sets out some helpful details for employers planning what action they need to take to prepare for the introduction of Secondary Pensions in Guernsey. In particular, it covers:

- which employees will fall within scope

- the minimum criteria schemes will need to meet in order to be compliant

- the information that schemes must provide to members

- definitions of a number of technical terms used within the legislation

- the Director of Revenue Services’ enforcement powers

- the penalties for non-compliance

What it means for Employers

If approved, Guernsey’s 2,200 employers will be required to automatically enrol “designated employees” into an “approbated pension scheme”. This could be either the employer’s own scheme or the new trust arrangement to be set up by the States. Both employers and employees will be required to contribute, unless an employee has chosen to opt out. The long-term minimum contribution rates will be 3.5% of applicable gross earnings for the employer and joint employer/employee contributions of 10%.

Designated Employees

These are employees satisfying all of the following:

- resident in Guernsey, Herm, Jethou or Alderney

- 16 years old or over

- under Pensionable Age²

- likely to earn more than the Lower Earnings Limit (£8,476 pa in 2023) per annum

- not in full-time education

Opt Outs?

Designated employees will be able to opt out, but will need to be re-enrolled every three years.

Will your scheme comply?

Schemes which satisfy the secondary pensions requirements will be known as “Approbated schemes” and will need to satisfy the following conditions:

- Approved by the Revenue Service under section 150 or 157A of the Income Tax (Guernsey) Law, 1975

- subject to a regulatory regime in one of the British Islands³

- must provide for auto enrolment

- must not require employees to contribute more than 10% of applicable gross earnings

- For Defined Contribution arrangements

- the employer must contribute

- the minimum contribution requirements must be met

- For Defined Benefit schemes

- an actuary must certify that:

- the benefits are likely to be at least equivalent, for the majority of members, to the benefits from the minimum contributions

- the scheme funding requirements are expected to be adequate to meet the cost of the benefits as they fall due

- For RATS

- must be employer-facilitated

- additional restrictions on loans

- if established by an employee, an employer has consented to use it

The requirement to be regulated means that, in practice, a Guernsey scheme will need to have either a licensed fiduciary as either the trustee or administrator.

How much will it cost

Whilst staff will need to be automatically enrolled, the system is only “semi-compulsory”, as employees will have the choice to opt out. However, their employer would need to re-enrol opt-outs again periodically.

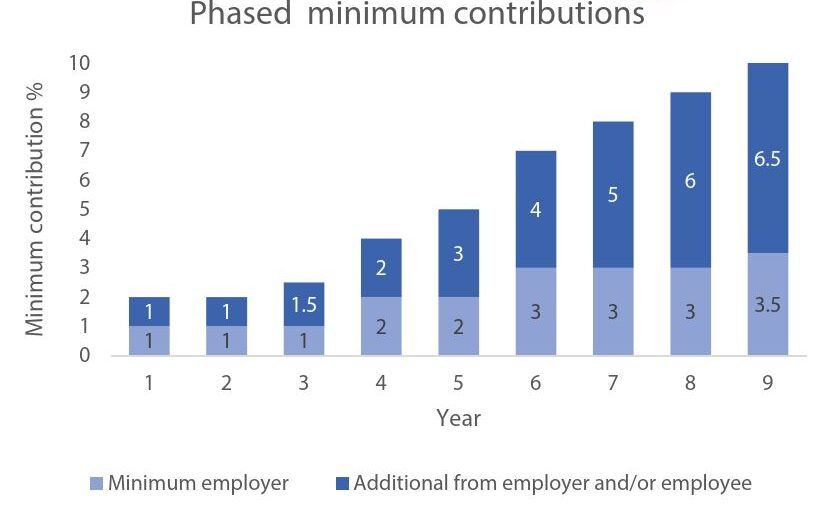

Phased introduction

Contributions will be based on the same earnings as those on which Social Security contributions are paid and will be phased in over 8 years (previously expected to be 7 years). Employers can opt to pay more than the minimum rate, provided that the joint employer/employee rate is not less than the minimum required in any particular year. We anticipate that there will be a phased introduction, with the largest employers having to comply first. There has been a previous indication that employers will have at least a year to prepare, so we do not anticipate secondary pensions requirements coming into force before 2024.

¹ The Secondary Pensions (Guernsey and Alderney) Law 2022

² which is being increased from 65 to 70 between 2020 and 2049

³ Schemes established in Jersey, before the commencement of the legislation, are expected to be exempt

We’re here to help

If you have any questions about secondary pensions or would like to talk through the options in your particular circumstances, please contact Mike Freer (mike.freer@bwcigroup.com) or Sarah de Garis (sarah.degaris@bwcigroup.com).

BWCI Pension Trustees Limited, which is regulated as a pension provider by the Guernsey Financial Services Commission, offers a range of services to help employers meet their obligations under secondary pensions, ranging from our Blue Riband suite of positive retirement solutions to a fully bespoke arrangement.