By Anthony Brewer at BWCI

anthony.brewer@bwcigroup.com

“an opportunity to refine and improve pensions provision”

Guernsey’s secondary pensions, which is analogous to auto-enrolment introduced in the UK back in 2012, is being phased in from 1 July 2024. This notable change in the obligations for employers is expected to expand the scale of personal pension saving in the Island significantly. Unfortunately, the risk of pensions poverty for the Island’s population is not immediately swept away by this new framework. Pensions is also not an area blessed with the luxury of quick-fixes, and if a problem appears (i.e. increasing poverty in retirement) it is likely to be too late to find a palatable solution for an entire generation.

Whilst pensions risk notionally sits with individuals, they may lack the expertise or time to give this important area sufficient consideration. Therefore, the onus often falls to employers and the government to ensure that general or default provisions are adequate. Employers and individuals could consider the expected pension outcomes, in terms of retirement incomes, from their current arrangements to ensure society is not sleepwalking into a crisis. Given the increased public attention on pensions currently, employers should also consider using attractive pensions provision as a valuable staff recruitment and retention tool.

What are the typical sources of income in retirement

Glancing over the key sources of retirement incomes highlights some of the potential challenges which lie ahead.

-

- States Pension – This provides the cornerstone of many retirees’ pensions¹. However, this benefit is being eroded given the gradual move in the relevant retirement age to 70 by 2049 – this represents a double whammy for individuals who both need to pay in for longer and receive benefits for a shorter period.

-

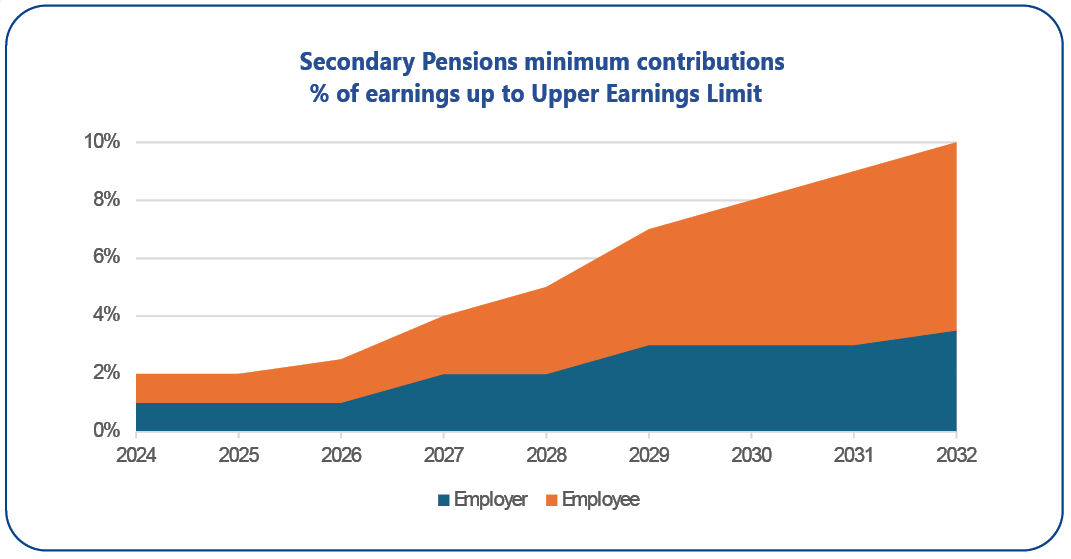

- Occupational/Personal pensions – Secondary pensions should provide a boost to this pot. However, the specified minimum contributions rise slowly to 10% of earnings in 2032; in many cases 10% annual contributions alone are unlikely to be sufficient to achieve comfortable incomes in retirement.

This also needs to be set against the decline of defined benefit (“DB”) arrangements, which are now almost completely replaced by defined contribution (“DC”) schemes in the private sector. DB tended to be more generous and far less risky for individuals. This is because an individual could predict what income they would receive in retirement. In addition, they were not exposed to investment or longevity risk as these were pooled with other individuals and then ultimately borne by their employer instead.

- Occupational/Personal pensions – Secondary pensions should provide a boost to this pot. However, the specified minimum contributions rise slowly to 10% of earnings in 2032; in many cases 10% annual contributions alone are unlikely to be sufficient to achieve comfortable incomes in retirement.

-

- Personal savings/investments – The lack of capital gains tax makes investments a potentially tax-efficient method of financing retirement in Guernsey. However, in practice, there are many who can not afford to save, or do not wish to do so, in case it reduces any top-up State benefits. This savings pot may therefore be close to non-existent for those most at risk of pensions poverty.

What can employers do?

Whilst crystal balls are not available, it is possible to model outcomes for employees based on their current arrangements. This can either be done using actual member data, or a simplified analysis based on “average” or typical employees, to see what range of retirement incomes is expected and how this compares to their requirements and aspirations.

Where this analysis suggests employees need to change something to improve their retirement outcomes, there is a range of options the employer can explore to help, for example:

- Contribution matching, either by promoting it more, if already available, or by offering it if not.

- Nudging employees towards contributing more – e.g. highlighting the option to increase pension contributions at pay-rise time.

- Reviewing investment strategy and costs of current pension arrangements.

- Reviewing compensation packages and tilting them towards a higher pension contribution component.

- Increasing general pensions engagement and by running employee education sessions, either on a one-to one or group basis.

Given the changes associated with secondary pensions, pensions are already on agendas. Employers can use this as an opportunity to refine and improve pensions provision more broadly. There are widespread challenges associated with recruiting at present; generous and well-articulated pension provision can act as a differentiator to help employers attract and retain the best staff. It should also be remembered that not all actions to help employees come with material costs for employers.

¹ up to £267.23 per week currently available