“the proposals go much further

than initially anticipated”

Back in 2018 the Isle of Man Financial Services Authority (IOMFSA) published a discussion document inviting feedback on its intention to enhance the regulatory framework for private pensions and their providers. It received 9 responses and published the feedback document in the second half of 2018, with a further consultation expected to be published in the first quarter of 2019. However, due to a change in regulatory priorities and the impact of the pandemic, this initial timetable has slipped somewhat!

The long-awaited “2019” consultation was finally published in July 2025, with responses required by 15 August, although this has now been extended to 1 September.

It is fair to say that the proposals go much further than initially anticipated back in 2018, with significant changes to the Retirement Benefits Schemes Act 2000 mooted.

What is being proposed?

The intention is to make some fairly substantial changes to the Retirement Benefits Scheme Act 2000 (RBSA00), with some other consequential changes to the Financial Services Act 2008 (FSA08) and the Insurance Act 2008 (IA08).

Much of the detail will be left to secondary legislation, but essentially the key proposals are:

- To bring pension service providers within the scope of business conduct and prudential regulation under the FSA08

- To introduce revised funding requirements for defined benefit schemes, broadly in line with the latest funding regime for UK pension schemes

- To make the regulatory framework more proportionate and move towards a more risk-based approach to supervision

How will it impact pension schemes?

The impact will vary between schemes, depending on how they are currently operated and whether they are covered by any of the, as yet unspecified, exemptions.

Scheme management

It is currently proposed that, unless exempted, pension scheme administrators and any trustee that acts by way of business hold an appropriate financial service license. Each scheme will need to have at least one licensed trustee.

Governance

Schemes will be required to have in place an effective system of governance.

Trustees and administrators

As well as professional trustees needing to be licensed, all trustees and administrators will be required to have an understanding of the law relating to pensions and trusts, as well as being conversant with the scheme’s documentation. The consultation indicates that the degree of knowledge and understanding would be relative to the nature and size of the scheme.

Funding requirements

Since it was first introduced, the RBSA00 has had funding provisions in relation to defined benefit (“DB”) schemes, however these were never enacted. The Bill proposes the introduction of an updated and more extensive funding regime, broadly mirroring that of the UK.

Currently, trustees of DB schemes are already required to have a statement of investment principles and a schedule of contributions. However, unless exempt, if the new requirements come into force, trustees will also need to put in place several new documents:

- A funding and investment strategy

- A statement of strategy

- A statement of funding principle

- Certification of a scheme’s technical provisions

- A recovery plan

Costs

It is proposed that the IOMFSA will be able to introduce fees in relation to:

- An application or notice in connection with the registration of a scheme

- Annual scheme registration

- A return submitted to the IOMFSA

We also expect administrative and actuarial costs for schemes to rise, due to additional funding documents.

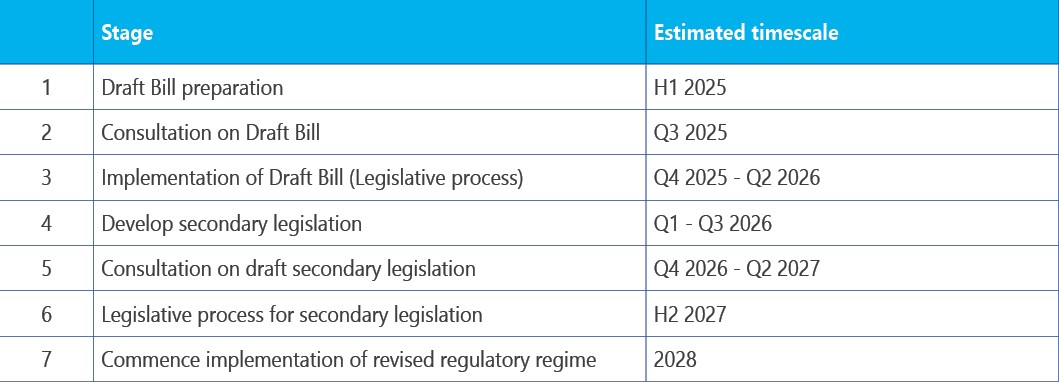

Timetable

The consultation documents include an outline timetable; once the Bill is enacted its provisions will be phased-in, starting with the regulation of pension providers from 2028, which is deemed to be the highest priority. The funding requirements for DB schemes would then be phased in from an unspecified later date.

BWCI has submitted a response to the consultation. We welcome the IOMFSA’s intention to move towards a more risk-based and proportionate framework for pension regulation. We do however have some concerns that the costs of compliance could be substantial, particularly for DB schemes, but the impact will not be known until further details of the exemptions are published. We are likely to have to wait until the consultation on the secondary legislation, which is expected to be 15-18 months away, before the impact on specific schemes will become clearer.