By Hannah Rosumek at BWCI Group

hannah.rosumek@bwcigroup.com

“enable decision-making to be streamlined”

The UK General Code of Practice came into force on 28th March 2024 and sets out the new governance requirements that are expected of a range of different types¹ of UK pension arrangements. Carl Stanford’s article in Issue 1 2024 provided a high-level overview of the areas covered by the Code. In this article we take a closer look at one of the new requirements for schemes with 100 or more members; the preparation of an “own risk assessment” (ORA). The Code highlights that ORAs should be proportionate to the complexity, size and nature of a scheme.

What’s an ORA?

An ORA considers how effective the current system of governance is, documenting the potential risks faced by a pension scheme and how they can be mitigated. While many pension schemes will already be monitoring key areas of risk, some additional work may be required to set up an ORA. Once completed, the findings from the ORA should then be reflected in the scheme’s decision-making processes and highlight where adjustments or new areas of work may need to be undertaken.

What’s covered?

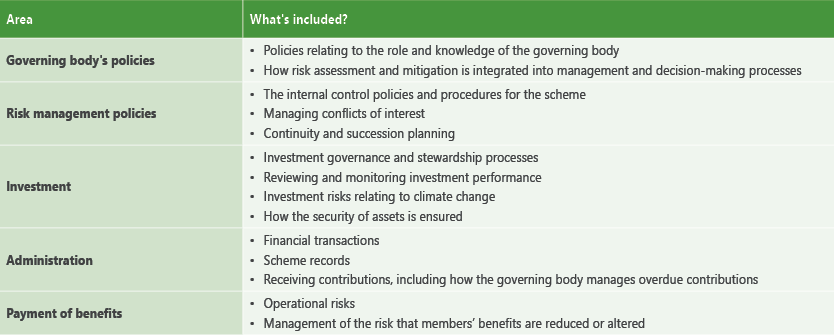

There are five broad areas that the assessments should cover, both in terms of effectiveness and risks arising:

Documenting an ORA

The ORA does not need to be published, but it must be documented and made available to The Pensions Regulator on request. All members of the governing body should see it and the chair will need to sign it off. The governing body should also consider what information to provide to members about the findings of the ORA. It is expected that governing bodies will play a significant role in drafting and reviewing the ORA, as they are ultimately responsible for ensuring that an ORA is produced. The secretary to the trustees, governance consultants and in-house teams are also likely to be able to assist in completing the assessment, particularly for the initial year.

When is it required?

Schemes will have approximately two years from 28th March 2024 to complete their first ORA. The exact period will depend on their scheme year end. After this initial transition period, an ORA will need to be reviewed at least once every three years. The Pensions Regulator recommends that new assessments should be carried out when risk management processes are created or updated, or when risks change materially. Some areas of the ORA should be updated more frequently, so it is desirable to establish a timetable setting out when each element of the ORA will be reviewed. It is not necessary for all elements of the ORA to be assessed at the same time, as long as they were all completed within the relevant timeframe.

If an ORA is not completed within the required timeframe, this could result in increased scrutiny from The Pensions Regulator, reputational damage and a negative impact in any legal defence.

The importance of an ORA

The Pensions Regulator is keen that completing an ORA is not just seen as a tick-box exercise. Having an effective system of governance will enable decision-making to be streamlined in the long term, helping to improve the outcomes for scheme members. To ensure that the system is effective, it is important that policies and procedures are updated regularly and reflect the changing circumstances of a scheme.

¹ occupational defined benefit, defined contribution, personal and public service