by John Martin

(Please contact John on 01481 728432 or email john.martin@bwcigroup.com

if you wish to discuss this article or anything relating to secondary pensions).

After 10 years in the making, secondary pensions have been approved by our deputies at the November States meeting. In addition, the legislation has now been formally enabled from 1 July 2024. This is Guernsey’s biggest shake-up of the pensions industry in a generation. Over several years, thousands of islanders who do not have a workplace pension will be signed up for one.

For employers who are struggling to juggle lots of demands, it’s understandable that secondary pensions can seem daunting. So, in order to help employers prepare, we thought it might be useful to put together the following FAQs:

1. Why does Guernsey need secondary pensions?

There are compelling reasons to reform Guernsey’s pension system. Research carried out in 2017 found that around 65% of the local working population did not have a private pension and were likely to be relying on the States pension for their old age.

The problem with depending on the States pension is that it’s not enough to support a comfortable retirement. In 2022, the full-rate single person’s States pension is approximately £12,200 per year. To add context to that, only around a quarter of States pensions are paid at the full-rate because it requires a long history of paying contributions. Put starkly, many workers are risking poverty in old age and they may be forced to rely on Income Support.

On top of all that, the States is worried about the future funding of the States pension to cope. Its sustainability is fundamentally threatened by an increasing average life expectancy, and an ageing population.

Under the current system, your contributions are not saved and invested for you, instead they go towards paying the pensions of those who have contributed in the past and have now reached States pension age. This basis of operating worked fine in the past when the ratio of workers to pensioners remained steady, but the demographic challenge has put it under strain.

2. When will the changes happen?

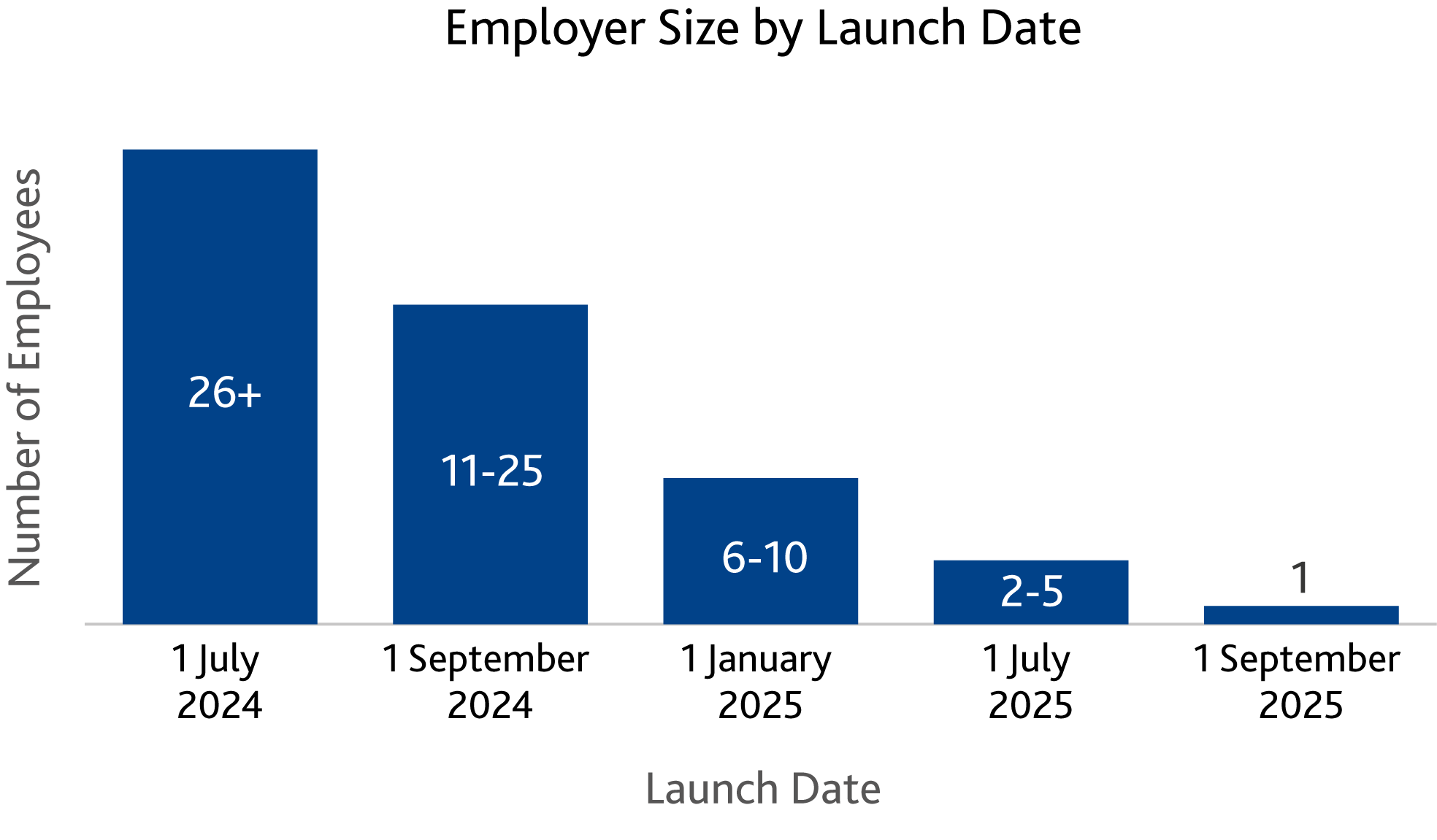

The States have approved to phase in secondary pensions so that it starts with big employers who have more than 26 employees, and over the following 15 months all employers would be brought into the scheme.

The launch date has been confirmed to be 1st July 2024.

3. How much will it cost?

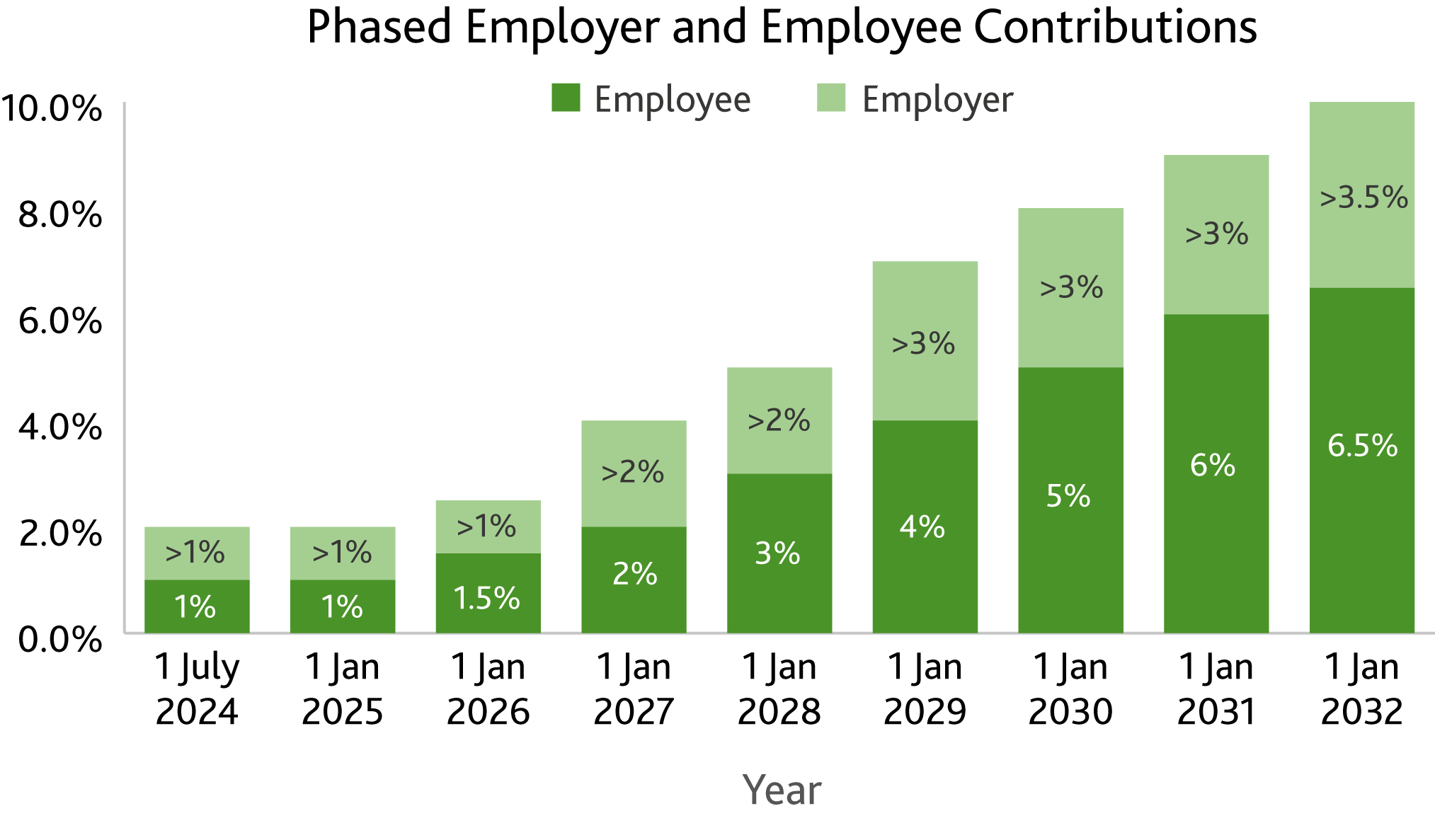

Initially, those included in auto-enrolment will contribute 1% of their gross earnings into their pensions from their pay. That modest figure would be matched by their employers. Contributions will be slowly stepped up, so, by the time nine years have elapsed, the employee will pay in 6.5% of their gross earnings and the employer will have to pitch in with 3.5%.

You may need to review your contributions rate structure and the remuneration these contributions are based on to ensure that the Employer/Employee contributions are above the statutory minimum amount as detailed in the chart below.

Note: Employees do not have to contribute if the total contributions meet the minimum levels.

4. Who?

Employers will be required to automatically enrol every employee who earns above the lower amount for social security contributions, is aged between 16 and their States pension age, is not in full-time education, and is currently not in an approbated pension scheme.

Self-employed individuals are not yet part of the secondary pensions, but the intention is to eventually bring them into the fold.

Employers who already offer their staff a pension scheme must ensure that it has ‘approbated scheme’ status and ensure compliance with other aspects.

5. What are the options for employers?

The welcome news is that there is a lot of flexibility for employers to choose a workplace pension that suits their personal circumstances whilst meeting the legal requirements. The States has appointed a default provider, but there is no obligation to use that particular scheme.

At BWCI Pension Trustees Limited (“BWCI”) we’ve already helped many employers with their pension schemes. We are one of the largest pension providers in Guernsey with about 140 staff, and with a track record of experience and expertise over the past 40 years.

Highly personalised and cost-effective, we make secondary pensions simple and quick. There’s no need to wait until your launch date, you can do it right now.